It's all about the Inventory and Lending

The questions for buyers and sellers today are inventory and the lending markets. Lending markets are at historic lows and at the same time the lending requirements are extremely tight, maybe never tighter. Yet, if you ask lenders how business is, they will tell you they’ve never been busier - locally, with new home buyers...not condo or townhome buyers.

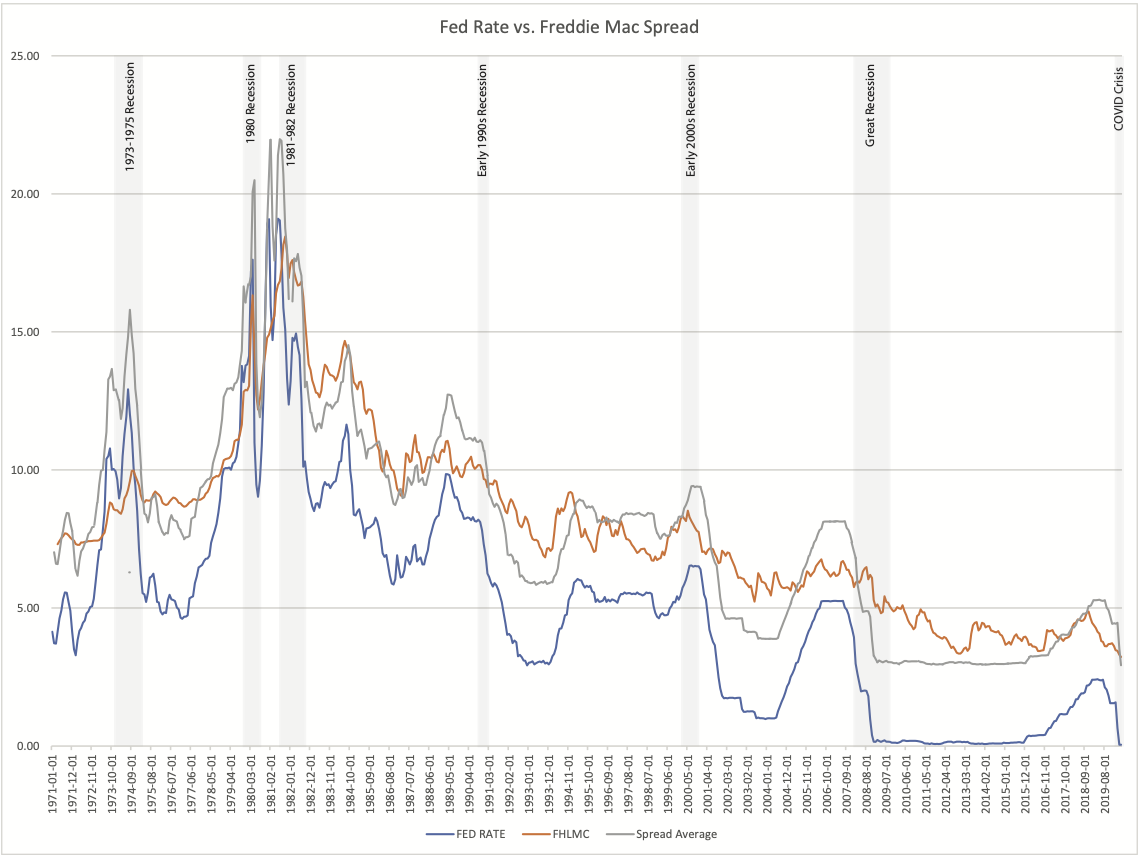

The FED’s bank rate of funds ( Effective Federal Funds Rate) is at 0.05%, and the spread between the FED’s rate and FHLMC (Freddie Mac) loan rates are moving above their adjusted average. It is noteworthy that between June of 2009, the end of the Great Recession to June of 2016, the period of quantitative easing, the FED rate was never below 0.09%. As of yesterday, 6/18/2020, Freddie Mac’s rate on a 30-year loan is 3.13% with 0.8 points, it’s historic low. But, you will need a FICA score of 800 or more to get this rate. Getting qualified is very hard, and to this add, many sellers and their agents are requiring loan qualification letters before showing properties, not just pre-qualification letters.

With FED Chairman Powell’s commitment to keeping the Fed rates low for the foreseeable future, we expect that interest rates will remain in this range and lending tight.

Factors driving low rates and tight lending include anticipated COVID 19 financial fallout. In response to this fallout, a number of FED regulators have recommended directing banks to not pay dividends so as to preserve capital. The debt associated with this fallout has been characterized as a “mountain of bad loans.”1 As Dennis Kelleher, the president and CEO of Better Markets stated earlier this week, “It strikes us as an absolute no-brainer that banks should not be allowed to eject capital out the front door through dividends when the Fed is injecting capital throughout the financial system to prevent its collapse,”2 All of this is dependent on FED Chair Powell’s assurances that the FED will shore up the banks if loan defaults rise. This is an ongoing debate.

In short, the banks are looking to maintain or increase their stock values. To this end, a number of banks have been buying back their outstanding shares. Last year Wells Fargo reduced their shares outstanding by 9.79%. So while the FED doling out money, the banks are doing their best to retain their stock values by buying back stock, distributing dividends, and reducing loan portfolio risk. They are not building reserves for future lending or a looming fallout. If there is money for lending much of it will undoubtedly come from the FED.

As a potential seller, the risk is a smaller pool of qualified buyers and a flood of homes entering the market. This will result in a drop in median home values nationally (the Bay Area may be slightly different). Everything depends on how much inventory there is and if buyers can obtain loans. Locally, with our robust economy, the impact will be less apparent, especially with higher value homes where buyers have a variety of financial tools available. This said we may already be seeing some of this fallout in the condominium and townhome markets.

And as a final note, below is a chart that looks at the spread between the FED rate and FHLMC (Freddie Mac’s) rate. With the average interest rate spread of 2.88% since the inception of FHLMC and the FED rate, whenever the combined rate has exceeded the rate that FHLMC charges, it has either coincided with or preceded a recession (the vertical grey bands). These might also be considered the times when mortgages are comparatively cheap when compared to the FED rate.

Other factors that may be playing into this chart are the application of better quantitative computer tools on the part of the FED. As one can see from 2000 on, the FED’s line appears less erratic as they have stabilized their policy.

Wherever one sees FHLMC's rate and the FED’s rate converge one can expect to see a recession. We just had this type of convergence in July of 2019 and again in February of this year. As a response to this and other factors, the FED cut its rate 93 basis points or 0.93% in February and another 60 basis points in March. To go into the full impact of these cuts is beyond the scope of this article, but they are noteworthy as they dramatically change the economic landscape.

We are now at the bottom of the chart. FED rates and FHLMC rates are at historic lows, which means the banks are looking at slim profits and, as mentioned, high default risk. For these reasons, lending and inventory will be critical to our recovery.

As always, we welcome your thoughts, comments, and responses. - Greg

Endnotes

1. https://www.wsj.com/articles/fed-unlikely-to-order-big-u-s-banks-to-suspend-dividends-sources-11585941449

2. https://www.americanbanker.com/news/banks-stick-with-dividend-plans-despite-potential-for-blowback

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.